Australia is just witnessing the first tentative signs of the new ‘Moo-ing Boom’. The demand for dairy products in Asia – in particular across China – is now impacting patterns of production, pricing and product development in Australia’s dairy industry.

So what are some of the key drivers and opportunities inherent in this new Boom?

Domestic shortages are not the new norm

There has been considerable focus on stock-outs and bare shelves – in particular with baby formula – making Australians ask whether this is the new norm for Australian-made dairy products. It is not.

The current consumer shortfalls are almost entirely due to production runs focused on Chinese preparations for ‘Singles Day’ – the largest online shopping event in the world. Ironic that baby formula is in such high demand on a day dedicated to singledom!

In anticipation of this, smart Australian companies have been shipping to China to await the expected demand. True to form, early indications suggest strong sales – $7 billion in merchandise sales in the first 90 minutes on just one Chinese retailer. Given dairy product prices in China may be up to 400% of Australian prices, it is probably fair to see why this has happened. But manufacturers are learning how to ride these peaks, and production cycles will do better at anticipating this every year going forward.

The publicity around Singles Day has also led to opportunistic hoarding by individual buyers in Australia. This usually involves syndicates buying at Australian retail prices and shipping to China through the ‘grey channel’ into mainland China. These behaviours will disappear once the Singles Day hype fades for another year.

The boom is NOT single market and NOT single product

The Moo-ing Boom is not reliant on a single market or a single product. Rather, it is underpinned by consistent growth in demand for dairy products from Asia and the Middle East. The ‘Moo-ing boom’ shows far greater signs of longer term sustainability than the mining boom.

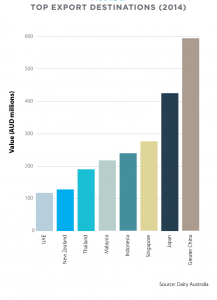

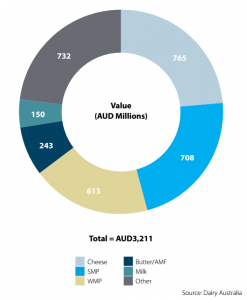

Dairy Australia’s analysis shows Australian exports relatively equal between cheese, whole milk powders and skim milk powders. It also shows that the value of exports is spread across many markets. While China is the single largest destination of our dairy products, it is exceeded by Singapore and Japan combined.

Compare this with Australian bulk commodity exports at the height of the mining boom – where respective categories were heavily dominated by one single market or another.

The boom may be volatile – but we must meet productivity challenge

The boom is riding a ‘perfect calm’ of a lower Australian dollar and reduced tariff rates into the key Asian markets. Free Trade Agreements with China, Japan and Korea. The FTAs will cut our tariffs on dairy products between 5% and 20%. In other words, Australian dairy into China, Japan and Korea will cost between 5% and 20% less when landed in these markets. This comes on top of an Australian dollar now 25% below where it was just over a year ago.

When combined with talk of a new mini baby boom in China, following China’s relaxation of its one child policy, the opportunities for an Australian-made dairy products push into Asia are clear.

Of course, there are no sure things. NZ has witnessed an incredible surge of dairy exports into China since its FTA with China in 2009. But this year has seen a dramatic fall in exports due in part to China’s growing domestic production, and increased supply into China from Europe.

According to ANZ’s excellent report on the China dairy opportunity, the key to success will be increasing dairy productivity – overall milk production as a product of a larger herd, with a wider area under dairy, with a higher milk yield. Under a moderate growth scenario, Australia could lift its annual 9.2 billion litres to 15 billion litres by 2025 – doubling our export revenue from $1.4 billion to $2.8 billion.

New product development is also critical. Australian dairy products can command a greater share of the premium supermarket shelf in Asia if we continue to innovate and listen to market demands. The best example of this is Baby Royale, a Traralgon-based infant formula manufacturer that struck a deal to develop and export premium organic halal infant formula into Malaysia. That is genuine innovation worth celebrating.

So bring on the Moo-ing Boom (a sub-division of the Dining Boom), and raise your glass (of milk) to another burgeoning Australian success.

For information on expanding into Asia, drop us a line at info@trade-worthy.com